What Type of Life Insurance Are Credit Policies Issued as

At the beginning of the sixth year the premium will increase to 800 per year but will remain level thereafter. Credit life insurance is typically issued with which of the following types of coverage.

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Credit life insurance also appeals to some for its characteristic as guaranteed issue life insurance.

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

. Most consumers wont need this type of insurance. At the end of the term there is no option to renew for the same premiums and the policy simply expires. Types Of Life Insurance Policies.

The world is developing at a frantic pace. Term life insurance You pay premiums oward the policy and if you die during the term the insurance company pays a set amount of money known as the death benefit to your designated beneficiary. Credit life is issued as a guaranteed issue policy with a decreasing term.

That means youre eligible for coverage simply by virtue of being a borrower. The face value of a. Type of life insurance Policy length Cash value Premiums Death benefit.

This type of policy consists of whole life on the breadwinner and convertible term on the spouse and children. Credit Life insurance is. This is an important issue in the life of modern man.

The type of policy that M has purchased is. The face amount will remain at 70000 throughout the life. Once the policy is issued additional children are automatically included at no extra cost.

A few other events may also be covered. The cost is typically more affordable than for a policy you buy straight from an insurance coverage company - geico life insurance. Term life and permanent life insurance coverage.

Ten year term insurance for a person aged 55 b. At the beginning of the sixth year the premium will increase to 800 per year but will remain level thereafter. Term life insurance coverage uses defense for.

Credit life insurance is a type of life insurance policy designed to pay off a borrowers outstanding debts if the borrower dies. What type of life insurance are credit policies issued as. Is a tool to reduce your risks.

Most Credit Life Insurance is issued as a Decreasing Term Life Insurance policy. Credit life insurance is a form of credit insurance which includes other insurance products that pay your debts if you are unable to like unemployment or disability credit insurance. The top notch remains the equivalent however the inclusion sum diminishes after some time in light of the fact that the obligation is being squared away by the protected.

Ten year term insurance for a person aged 45 c. Credit life insurance is typically issued with which of the following types of coverage. Credit life insurance 4Industrial or service life insurance.

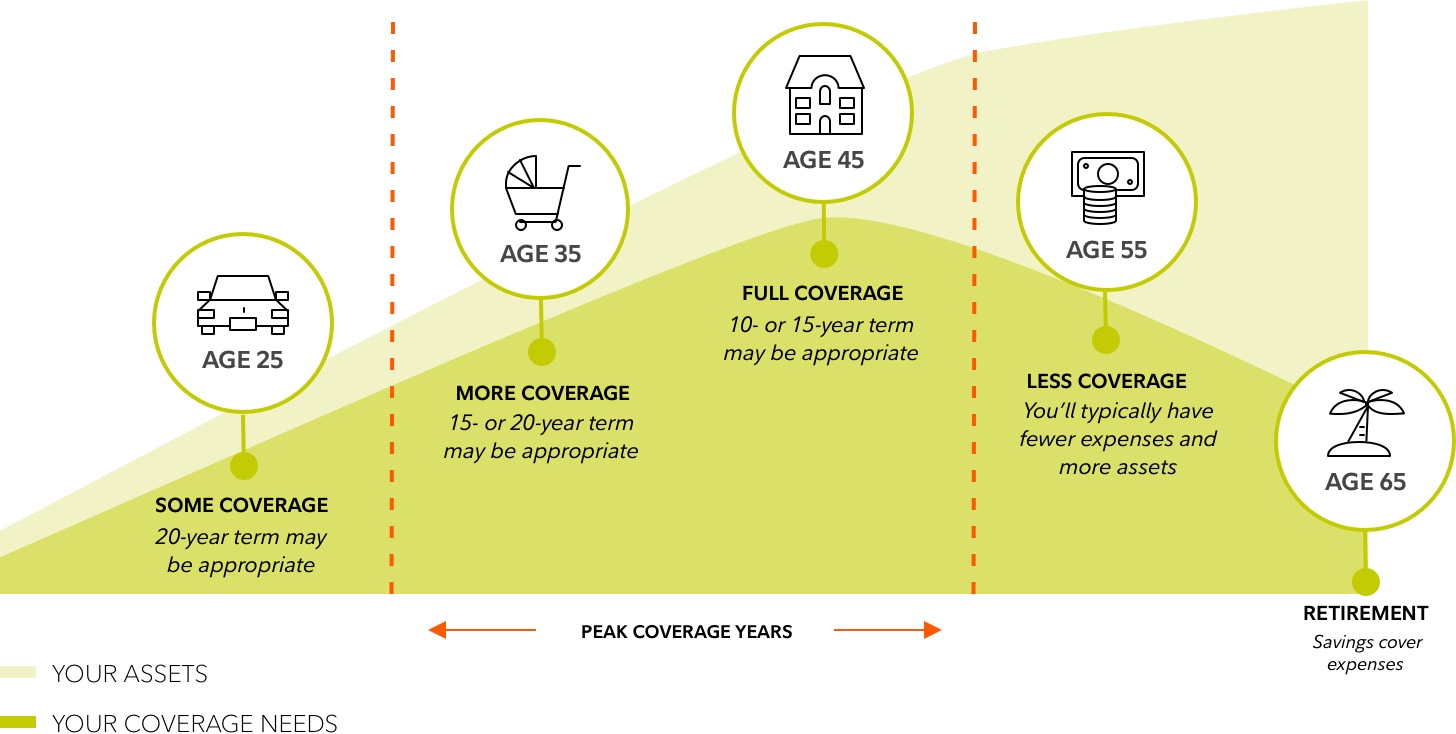

In these policies the benefits usually decrease over the life of the policy. If you die during that time money is paid to your beneficiaries but when the term is over. Some life insurance policy types are categorized based on their medical underwriting or lack thereof such as guaranteed issue life insurance.

Level annual renewable. Also known as funeral or burial insurance final expense insurance is a type of whole life insurance that offers a smaller and more affordable death benefit designed to help handle funeral costs medical bills or outstanding credit card debt. And if the accident insurance event occurs the insurance company will bear all or all of the costs in full or in part.

Why do you need credit life insurance is typically issued with which of the following types of coverage. While other types of life insurance may have age and health requirements final expense policies can be easier for older or less-healthy. Yearly renewable term insurance for a person aged 55 d.

Yearly renewable term insurance for a person aged 45. When a ten year renewable term life insurance policy issued at age 45 is renewed the premium rate will be the current rate for a. Term The type of insurance used is decreasing term with the term matched to the length of the loan period though usually limited to 10 years or less and the decreasing insurance amount matched to the declining loan balance.

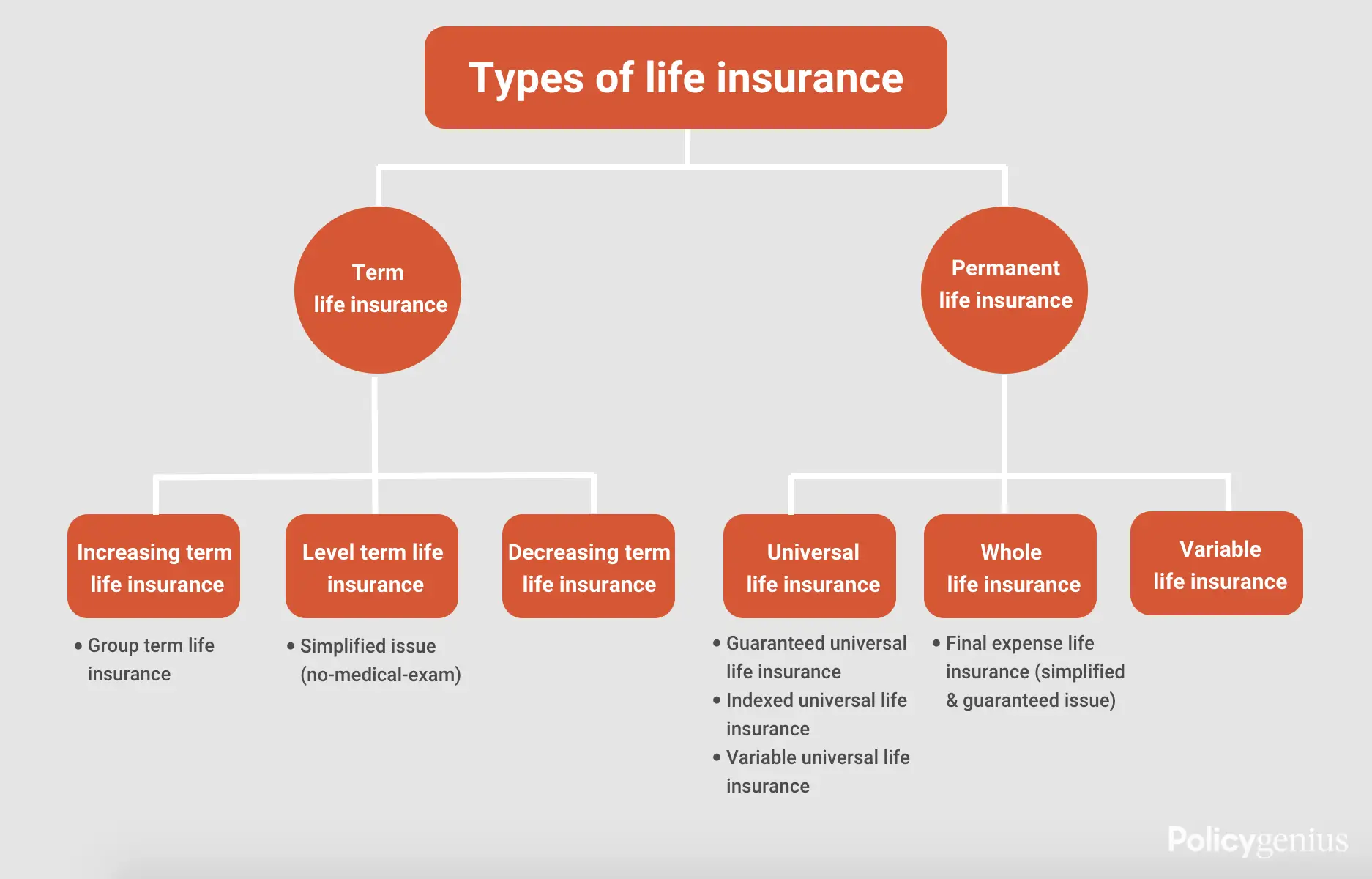

Level term period varies but often can be 5 10 15 20 or 30 years. It shields them against the risk that clients wont pay what they owe due to insolvency. For the most part there are two types of life insurance plans - either term or permanent plans or some combination of the two.

M purchases a 70000 Life Insurance Policy with premium payments of 550 a year for the first 5 years. What type of life insurance are credit policies issued as. Practically every person has insurance policy today.

Majority of the credit life insurance policies are given as a decreasing term life insurance strategy. Trade credit insurance protects businesses that sell goods and services on credit. Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses.

The premium stays the same but the coverage amount decreases over time because the debt is being paid down by the insured. With a term life policy you get coverage for a defined length of time say 10 years. There are many types of life insurance policies that can help protect your family and they all fall into two main categories.

Issued in an amount not to exceed the amount of the loan. The face amount will remain at 70000 throughout the life of the policy. What type of life insurance are credit policies issued as.

There are 2 main kinds of life insurance. Life insurers offer various forms of term plans and traditional life policies as well as interest sensitive products which have become more prevalent since the 1980s. Decreasing term L aged 50 and Ls spouse 48 have one natural child and one adopted child.

What type of life insurance are credit policies issued as. You wont need to undergo a medical exam to get this kind of policy. That is the closer one gets to the end of the policy term the less the benefit will typically be.

M purchases a 70000 Life Insurance Policy with premium payments of 550 a year for the first 5 years. What type of insurance offers permanent life coverage with premiums that are payable for life.

Choosing A Life Insurance Policy Video Lesson Transcript Study Com

Important Documents Checklist Checklist Important Documents 30 Day Challenge

How To Find Out If Someone Has Life Insurance Unclaimed Policies

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

How Does Life Insurance Work Forbes Advisor

Metlife Insurance Offers Diverse Forms Of Insurance Options That Ranges From Auto Home Life Insurance Quotes Dental Insurance Plans Life Insurance For Seniors

9 Best Life Insurance Companies Of April 2022 Money

Life Insurance Explained Types Of Life Insurance Alllife

Understanding The Life Insurance Medical Exam Policygenius

How To Buy Life Insurance In March 2022 Policygenius

Walmart Credit Card Apply Apply For Walmart Credit Card Quotedg Credit Card Apply Business Credit Cards Credit Card Online

5 Different Types Of Life Insurance Policies In India

Term Life Insurance Financial Resources Coverage Options Fidelity

How To Find Lost Life Insurance Policies Life Insurance Policy Life Insurance Life Insurance For Seniors

Types Of Life Insurance Explained Progressive

When Is Life Insurance An Asset Smartasset

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Comments

Post a Comment